Combined group would create an industry leader with an extensive global product portfolio and financial strength to support long-term growth objectives

TORONTO, CANADA and LONDON, UK – November 29, 2024 – ABC Technologies (the “Company”) today announces that it has reached an agreement on the terms of a recommended all-cash offer for the acquisition by ABC Technologies Acquisitions Limited of the entire issued and to be issued ordinary share capital of TI Fluid Systems plc (“TI Fluid Systems”).

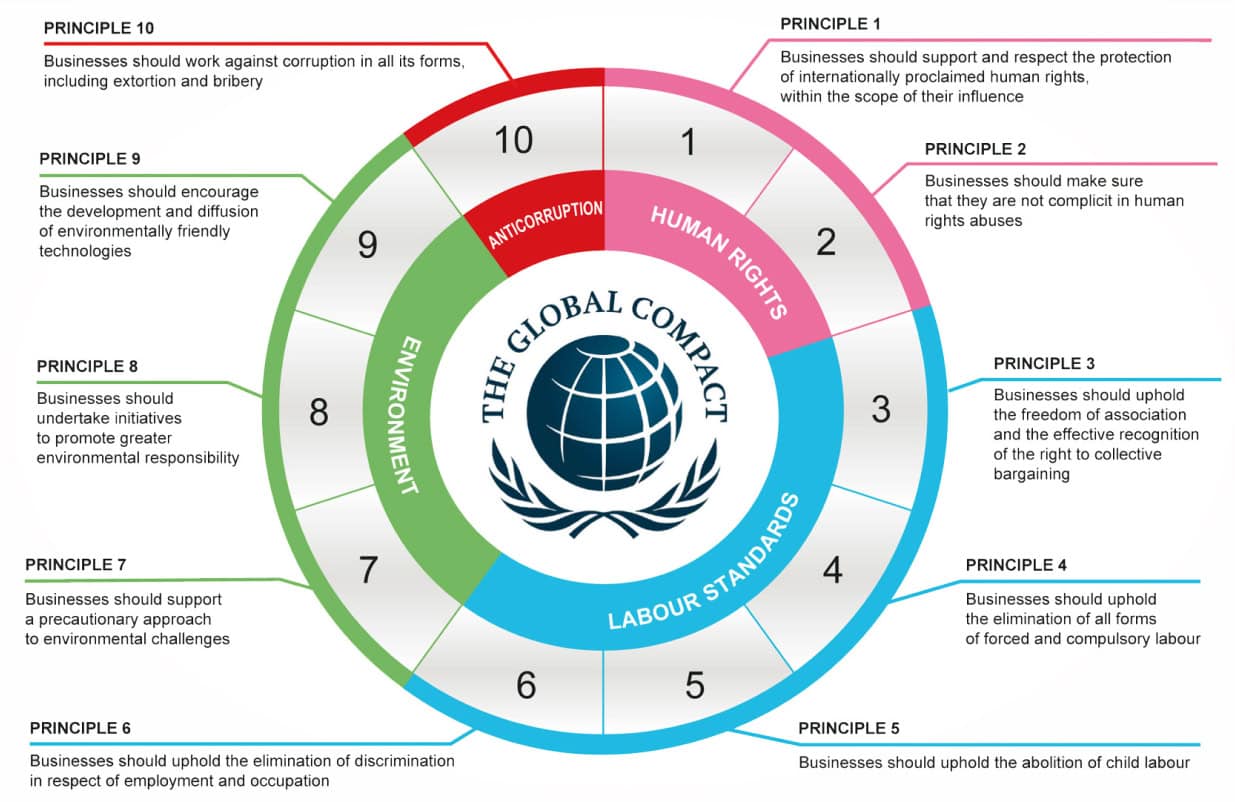

TI Fluid Systems is a London-listed, market-leading global manufacturer of thermal and fluid system solutions for the full range of current and developing vehicle architectures. Operating across 27 countries and serving all major automotive manufacturers, TI Fluid Systems has a commitment to operational excellence and sustainability worldwide.

Together, ABC Technologies and TI Fluid Systems will enjoy an expanded global footprint and enhanced product portfolio. This will allow access to a broader and more diversified range of customers, including some of the largest and most recognizable automotive OEMs and Tier One suppliers worldwide.

“This transaction is a transformative strategic opportunity which unlocks value for all of our stakeholders and provides a platform for further growth,” said Terry Campbell, President and CEO, ABC Technologies. “A combined business will enable us to better serve our customers, and I am excited for our teammates as we continue to build a winning future. We will be persistent in seeking alignment with organizations that have proven capabilities to further ABC’s success story.”

Combining the rich heritages of ABC Technologies and TI Fluid Systems – both established leading manufacturers across different product segments – will create a business that benefits from an enhanced go-to-market proposition and greater financial strength to support the long-term growth objectives and a winning vision for the future. ABC Technologies is majority-owned by funds managed by affiliates of Apollo Global Management, Inc.

Under the terms of the transaction, shareholders of TI Fluid Systems will be entitled to receive 200 pence a share, valuing TI Fluid Systems at an enterprise value of approximately £1,831 million.

The Acquisition is currently expected to complete in H1 2025, subject to shareholder and other relevant legal and regulatory approvals.

Lazard acted as lead financial advisor to ABC Technologies; Citi, TD Securities and Scotiabank also acted as financial advisers.

Kirkland & Ellis International acted as legal advisor to ABC Technologies and Paul, Weiss, Rifkind, Wharton & Garrison acted as legal advisor in respect of regulatory and financing matters.

This press release must be read in conjunction with the Rule 2.7 announcement which is available on the London Stock Exchange RNS and along with other documents related to the transaction on www.projectgolfoffer.com.

MEDIA CONTACTS

ABC Technologies

Tom Hajkus, Global Communications Manager

Thomas.Hajkus@abctech.com

Tel: + 1 248-648-0173

FGS Global (PR Adviser to ABC Technologies)

Charlie Chichester

Rory King

ABCTech-UK@fgsglobal.com

Tel: + 44 (0) 20 7251 3801